The road to the future leads us smack into the wall.

-Jacques Cousteau

We believe the problem is clear: EO and Gamma sterilization represent 50% and 40% of the sterilization market, respectively, but both have significant sustainability concerns associated with them. Studying this problem back in 2019 led us to found NextBeam with a focus on sustainable E-Beam technology based on our thesis that the growing sterilization market was moving in a direction that incumbent modalities could not accommodate.

At NextBeam we believe that up to 60% of medical devices could be sterilized with beam technology over the coming decade. We thought it might be useful to lay out our thinking on the market as well as how we arrive at this number. The key assumptions are:

5 Key Assumptions

(1) Medical Device Market grows by 5% CAGR over the next decade

The medical device market – overall – will grow by approximately 5% CAGR for the next decade: KPMG (5% CAGR) and Fortune Business (5.9% CAGR) corroborate these estimates.

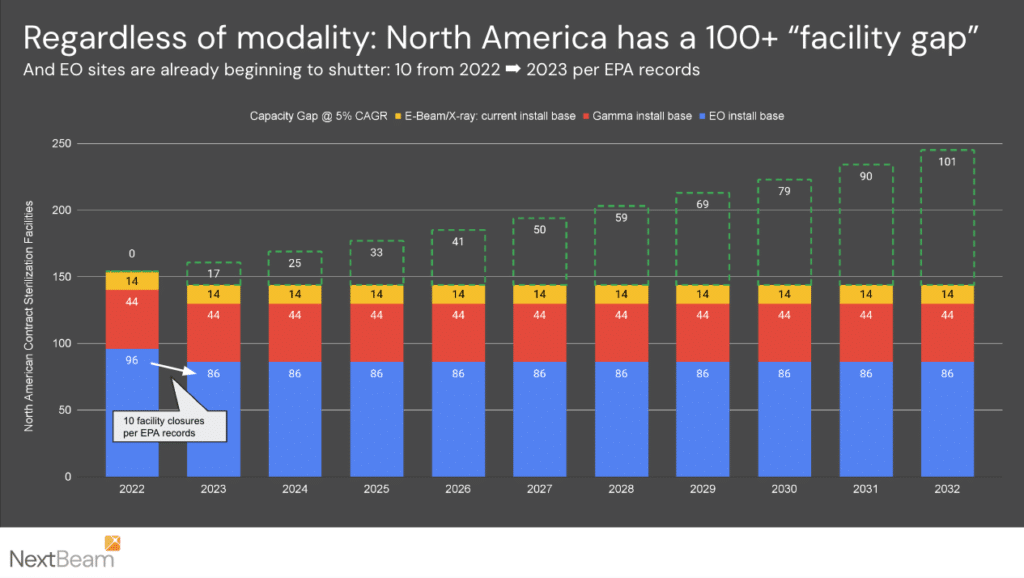

(2) EO will be maintained at its current volumes

Though we actually expect EO activity to dip significantly (up to ~25%) from its 2022 peak of 96 facilities, we assume that it will be level. Now at a count of 86 as of January 2024, most environmental retrofits will cause EO facilities to initially lose 15-25% of their capacity, even at great cost ($10M+ per facility). However, we expect the industry to build back over time – EO is an effective sterilant for a number of critical PTFE-containing devices, like catheters, that we believe it will endure over the long term.

(3) Gamma will be constrained by a lack of Cobalt-60 supply

The nuclear industry can make the medical device industry look as if it moves at lightspeed. Historically the Cobalt-60 isotope used in gamma plants was produced in certain specialized types of reactors (Pressurized Heavy Water Reactors and Light Water Graphite Reactors). The Nordion-Westinghouse partnership announced in 2020 is expected to allow the production of Cobalt-60 in newer reactors, but we believe that it will require the better part of a decade to grow supply past current levels (e.g. Canada/Pickering and other Russian sites that produce Co-60 are approaching end-of-life and will need to be replaced).

(4) Beam technologies can be built in North America at reasonable rates

The major suppliers of equipment can supply ~10 facilities per year today and more in the future with sufficient demand.

(5) All facilities have the same average capacity

This is the weakest assumption in our model. Facilities can have significantly different levels of capacity, although these details change with time and are not typically well-shared in the industry. However, across 150+ facilities, the law of averages tends to help compensate for this coarse assumption.

The consequences of the above are as follows:

At 5% CAGR over a decade, 63% more capacity will be required by 2033:

Overall we expect the current ~150 US & nearshore sterilization facilities to grow to a total of 250 sterilization facilities – creating demand for ~100 new facilities.

In terms of contract sterilization (relied upon by most customers), our December 2023 contract sterilization map shows 91 contract sterilization facilities across the USA. Assuming proportions do not change, we expect approximately 60 new contract sterilization facilities over the next decade.

Of course – this is a simple facility-level analysis. “Super-sizing” existing facilities may happen as well, but we expect the net results to be similar here.

What modalities will comprise these new facilities?

Our NextBeam view is that making significant investments in Gamma or EO modalities is fraught at this time:

- EO still carries legal, regulatory, and headline risk – In the wake of the ~$900M of 2023 settlements paid out by Sterigenics alone, new lawsuits are still being filed. We have no view on the validity or strength of these suits but expect that their existence will act as a significant brake on the addition of new facilities. That said, we do not expect the EPA’s stated desire to eliminate EO plants to completely disappear: future legislation could impact these facilities even after this next round of rulemaking (expected shortly as of this writing). These are both tough risks to account for by those making new capital investment decisions.

- Growth in gamma capacity is possible but won’t be fast – As suggested above, Nordion implies it is possible to nearly double the amount of gamma supply by modifying future Westinghouse nuclear reactors, but the timelines on this could be extremely protracted. There is only one AP1000 reactor about to come online in the USA, and it has had a 14yr construction period thus far.

We are in a unique position to see E-Beam technologies (E-Beam and X-ray) as uniquely applicable based on our discussions with current and prospective customers. Broadly speaking, these large medical device companies are becoming increasingly sophisticated as to how they analyze terminal sterilization due to EO-related risk factors as well as the fragility of some terminal sterilization options that were exposed during the CoV-19 pandemic (e.g. constrained gamma supply). We are aware of multiple projects underway across manufacturers to identify and convert devices away from EO and gamma sterilization.

For Gamma-to-E-Beam migrations, lightweight, low-density medical devices with reasonable allowable dose uniformity ratios (DURs) of 1.8 or better often do exceptionally well in E-Beam, and allow E-Beam providers to process efficiently at very high volumes. For higher density / low allowable DUR products, X-ray can provide equivalent or better performance to gamma.

The EO-to-E-Beam path is trickier, with material compatibility being the primary concern. Our conversations on the possibility of migrating devices from EO to radiation sterilization generally break down into 4 categories:

- Beam conversion is extremely unlikely – These are generally devices that rely extensively on PTFE surface coatings for critical performance, like some catheters.

- Beam conversion is possible, but a great deal of work – These devices generally could be made out of materials that are radiation compatible, but the challenges are significant and the reengineering, test, and validation work/cost is effectively equivalent to initial development cost.

- Beam conversion is possible with minor modifications – These devices typically require small modifications to non-functionality-critical areas: e.g. packaging. Engineering work and validation is required, but comparably “low lift.”

- Beam conversion is possible with minimal testing – Per the FDA’s guidance on “Deciding When to Submit a 510(k) for a Change to an Existing Device” (page 24) manufacturers making changes to Class I sterile or Class II devices (e.g. 80%+ of medical devices) that do not affect biocompatibility can make these shifts from one “established category A” modality (e.g. EO to E-Beam) without submitting a new 510(k).

For our analysis, we assume that medical devices are evenly split into these categories, and thus that 50% of EO products, over time, may be converted into a radiation modality. The chart below lays out the net result: if new radiation sterilization flows to E-Beam/X-ray, and ~50% of new EO moves to Beam radiation over time, we end up with ~46% of devices in Beam technologies, with the proportion of EO dropping to 27% over the next decade.

Putting It All Together

Depending on the source, we have seen others estimate the amount of medical devices that can convert to E-Beam range from 35-80%, so our analysis is in the middle of “wisdom of the crowd” estimates. But in the end, the exact number isn’t as important as the overall idea: that as a medical device industry, we should be preparing for a world where we are preparing for a future of beam and preserving EO and gamma capacity for those products that truly require it.

We founded NextBeam to help the medical device sterilization industry transition to a sustainable future. Our 60% analysis represents what is possible – but what ultimately will make this transition happen is the concerted effort of sterility and medical device industry professionals around the country. So – we’re always eager to talk to our colleagues across the industry to help them understand what transition can look like for them. Contact us for further discussions on how NextBeam can be a part of your sustainable sterilization solutions.